Welcome to Our Vast Self-Study Catalogue for Flexible Learning!

Unlock a world of knowledge and professional development with our extensive self-study catalogue. Whether you're looking to enhance your skills, stay updated with industry standards, or pursue professional certifications, our recorded sessions offer the flexibility you need to learn at your own pace and convenience.

Elevate your career with just a click. Our user-friendly CPE platform makes it easy to explore, manage, and enroll in courses that cater to your specific needs and career or business goals.

With our self-study catalogue, embark on a learning journey that adapts to your schedule and empowers your professional growth. Take the first step towards a brighter future—explore our catalogue today!

NASBA Sponsor #: 143337

IRS CE Provider #: QQTMI

Self-Study Catalogue

Tax Research Part 1 - Fundamentals (SSDP12)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Taxes)

Exploring Client Advisory Services - Entity Type (SSDP13)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Accounting)

Mastering Charitable Remainder Trusts and Form 5227 Compliance (SSAJW03)

- Faculty: Arthur Werner

- Credits: 2 NASBA and IRS (Taxes)

The Preparation of Forms 706 and 709 : Understanding the Law (SSAJW04)

- Faculty: Arthur Werner

- Credits: 2 NASBA and IRS (Taxes)

Line-by-Line Preparation of Form 706 and 709 (SSAJW05)

- Faculty: Arthur Werner

- Credits: 4 NASBA and IRS (Taxes)

Form 1099 Update : New Reporting Rules and Revisions (SSSM01)

- Faculty: Steven D. Mercatante

- Credits: 2 NASBA and IRS (Taxes)

How to Choose the Right Business Entity for Your Client (SSSD01)

- Faculty: Steven C. Dilley

- Credits: 2 NASBA and IRS (Taxes)

Partnership & S Corporations: How to Calculate Basis (SSSD02)

- Faculty: Steven C. Dilley

- Credits: 4 NASBA and IRS (Taxes)

Non-Profits and Public Charities Taxation Rules and Preparing Form 990 (SSSD03)

- Faculty: Steven C. Dilley

- Credits: 2 NASBA and IRS (Taxes)

Financial & Tax Accounting for Partnerships & LLCs (SSSD04)

- Faculty: Steven C. Dilley

- Credits: 4 NASBA and IRS (Taxes)

Lifecycle Financial Planning: Estate Planning - Form 706 Basics (SSDP01)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Taxes)

Fiduciary Accounting: Fundamentals & Rules (SSDA01)

- Faculty: Doug Van Der Aa

- Credits: 2 NASBA and IRS (Taxes)

Fiduciary Accounting for Estates and Trusts under Form 1041 (SSDA02)

- Faculty: Doug Van Der Aa

- Credits: 4 NASBA and IRS (Taxes)

Lifecycle Financial Planning: Estate Planning - A Primer on Gifting (SSDP02)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Taxes)

Lifecycle Financial Planning: Estate Planning - Will & Advance Directive Considerations (SSDP03)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Taxes)

Understanding Partnership Taxation (EBDP01)

- Faculty: David Peters

- Credits:NA

Understanding S Corporation Taxation (EBDP02)

- Faculty: David Peters

- Credits:NA

One Big Beautiful Act Of 2025 Business Overview (SSSD05)

- Faculty: Steven C. Dilley

- Credits: 2 NASBA and IRS (Taxes)

One Big Beautiful Act Of 2025 Individual Overview (SSSD06)

- Faculty: Steven C. Dilley

- Credits: 2 NASBA and IRS (Taxes)

Understanding Partnership Taxation - Basis & Contributions (SSDP18)

- Faculty: David Peters

- Credits: 3 NASBA and IRS (Taxes)

Understanding Partnership Taxation - Schedules K-2 & K-3 (SSDP19)

- Faculty: David Peters

- Credits: 5 NASBA and IRS (Taxes)

Keeping Up with the Tax Code - Basis Calculations for S-Corps & Partnerships (SSDP20)

- Faculty: David Peters

- Credits: 1 NASBA and IRS (Taxes)

No records found

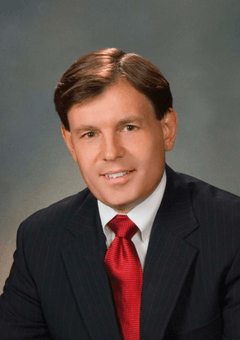

Our Faculty

Robert S Keebler

Bradley Burnett